Shared ownership with Northstone.

We’ve put together a quick guide that explains what Shared Ownership is, if you’re eligible and whether it’s suitable for you.

So, how does Shared Ownership work?

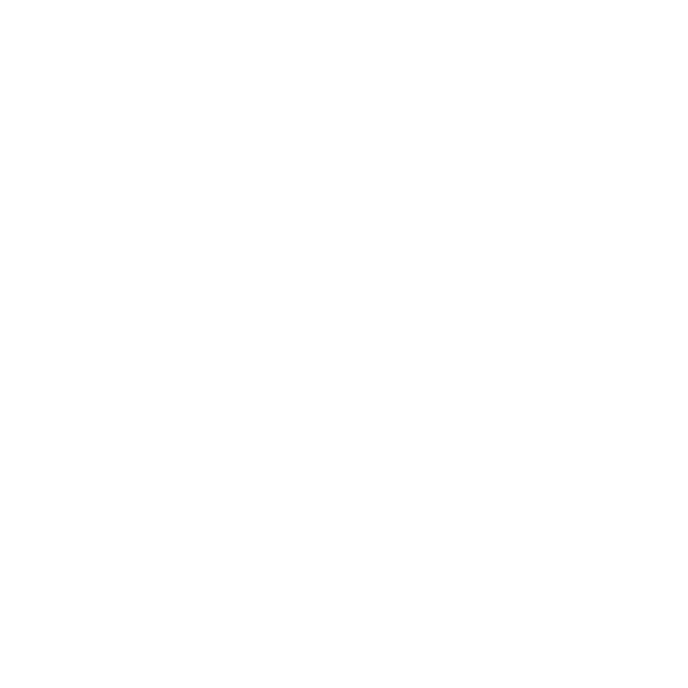

You buy a 50% share of the home.

Our Shared Ownership scheme allows you to buy part of a home, and pay a mortgage on that part.

The rest is owned by a Heylo, a shared ownership provider, and you pay them rent on it. It’s a way to own a home with a smaller deposit and mortgage, and over time, you can buy more of the home until you own it completely. It’s good for people who can’t afford to buy a whole home on their own right away.

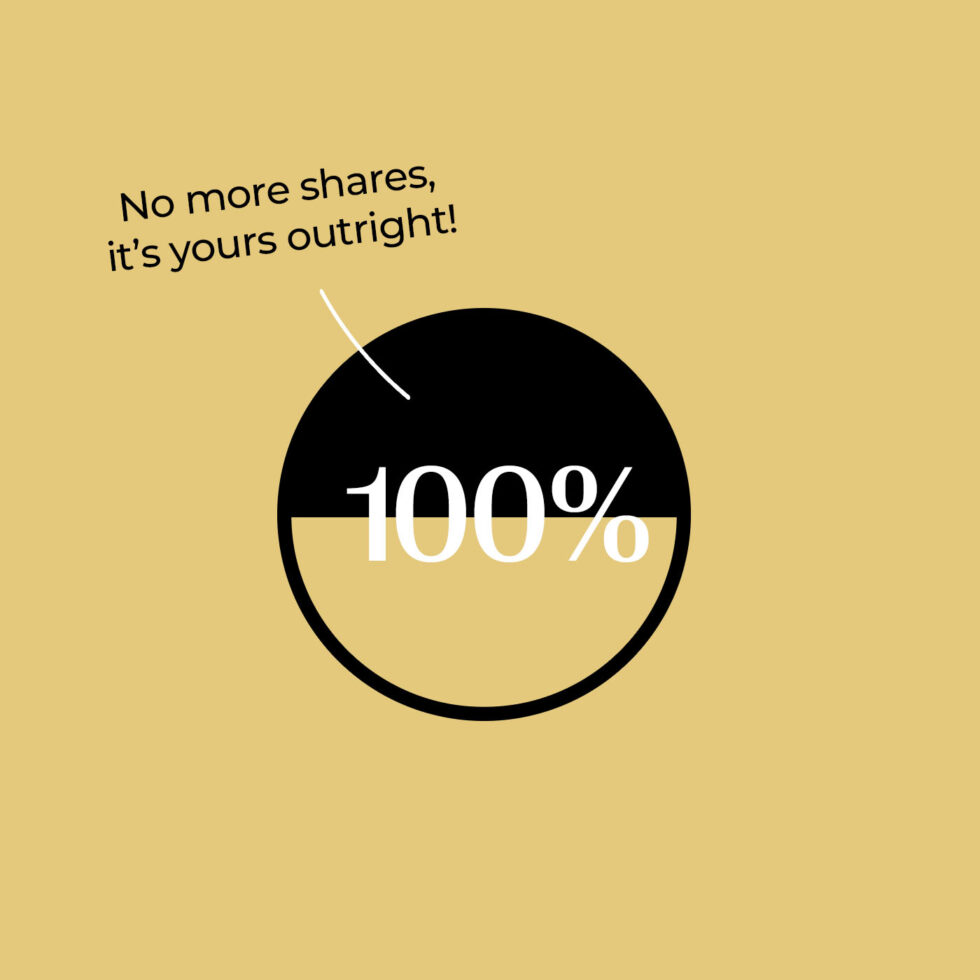

Can I own the home fully?

You can increase your ownership to 100% of the home.

You can increase your share in your property at any time after you complete your initial purchase. This is known as ‘staircasing’. If you increase to 100% ownership, then you will no longer need to pay rent.

You can staircase at any time of your choosing and staircase as many times as you want. Please refer to your lease for minimum staircasing increments.

You can find out more about staircasing on your home at https://heylohousing.com/staircasing

What are the benefits?

Lower Monthly Costs

Because the mortgage and rent payments are typically lower than they would be if buying outright or renting, shared ownership can help to lower monthly housing costs.

Increased affordability

You’ll be able to buy a home that might previously have been outside of your price range. This is because you’ll only need to finance 50% of the property rather than the full 100%.

It’s a step onto the property ladder

Shared Ownership is an opportunity to buy a home where you might not had the chance previously. When you own a home you’ll be paying off your mortgage and building equity, as an alternative to spending money just on renting.

Am I eligible?

Can I use the Shared Ownership scheme?

Shared Ownership is aimed at helping people who can’t afford to buy a suitable property on the open market. Purchasers are subject to eligibility and affordability requirements.

The general eligibility criteria for our Heylo Shared Ownership Scheme are as follows:

- Buyers must be at least 18 years old

- Buyers must have a total household income under £80,000

- If the buyers have a current home then they must sell this before buying their shared ownership home

For a full list of eligibility, visit Heylo’s website.

Can I resell my home?

Yes, you can sell your home!

You first need to contact Heylo, our Shared Ownership provider. The primary purpose of the scheme is to help as many people as possible into affordable home ownership, so Heylo will initially need the opportunity to find a new buyer on your behalf.

If they can’t find a suitable buyer within a set period of time (the timeframe will be set out in your lease) you can then market your property at 100% on the open market.

When you sell your home, you’ll receive the value of your share back (50% or higher if you have been buying more shares). And if house prices have risen, then the value of your share will have too.

What are my rights and responsibilities?

You are responsible for all utility bills and redecoration of your property!

It’s your place, your space – so make it your own! If you have any queries regarding repairs or maintenance not covered by your new build warranty you should contact Heylo’s Property Management team who can provide guidance and assistance.

If you wanted to make any structural changes, you would need to apply in writing to Heylo outlining the changes you would like to make. Heylo will review the application and will be in touch with a decision or requesting more information.

What are the costs involved?

Rent

You will need to pay rent on the share you don’t purchase, this is collected monthly via direct debit.

Rent rates are from 2.75% (on the share you don’t purchase) and increases annually by either RPI + 0.5% or CPI +1% (dependent on the terms of your lease).

Reservation fee

You will need to pay a £500 reservation fee to secure your home. Please speak to the sales team at the development for more info.

Lease management fee

The lease management fees for Heylo homeowners will be £25.73 per month until 31/03/2025 and increases annually in line with RPI.

Building insurance

Heylo as your landlord will take out buildings insurance for your property and recharge this back to you annually.

When completing your purchase, your solicitors will be able to advise you of the final cost for this compulsory insurance.

Estate Charge/Service Fee

You will need to pay the housebuilder directly for any estate or service charge fees associated with your home.

Please speak to the sales team at the development for more information on estate or service charge fees payable.

On completion

You will need to pay the rent and lease management fee for the remaining days of the month in which you complete and for the following month. This is not an additional admin or months rent, rent is payable in advance to allow time for your direct debit to be set up. Rent and lease management fee will be collected via direct debit in your third month.

Deal of the week – Plot 20

Plot 20 is a stunning 3 bed semi-detached Nine74 and is now available for £260,000.

This deal includes a £13,250 cash contribution from us and upgraded flooring throughout the home. Ready to move in now – for more details get in touch!

Creating homes and communities that people love.

We build sustainable new homes in great locations.